Most financial advisors don’t manage your 401(k), 403(b) or Thrift Savings Plan (TSP).

At Scarborough Capital Management, we provide the practical financial planning and investment management you need…starting with your retirement account.

You’ll get affordable professional management with unlimited phone and email support to keep your workplace retirement account on track. And there’s no minimum account requirement.

- Your account is managed according to your personal risk profile

- No more worrying about when to buy or sell

- No need to move your account

- All for one flat, affordable monthly fee.

Will Your 401(k) Be Ready For You?

Find Out Your Retirement Readiness.

Talk to a Scarborough Advisor today for a no-obligation Retirement Review.

LET US HELP ELEVATE YOUR 401(k)!

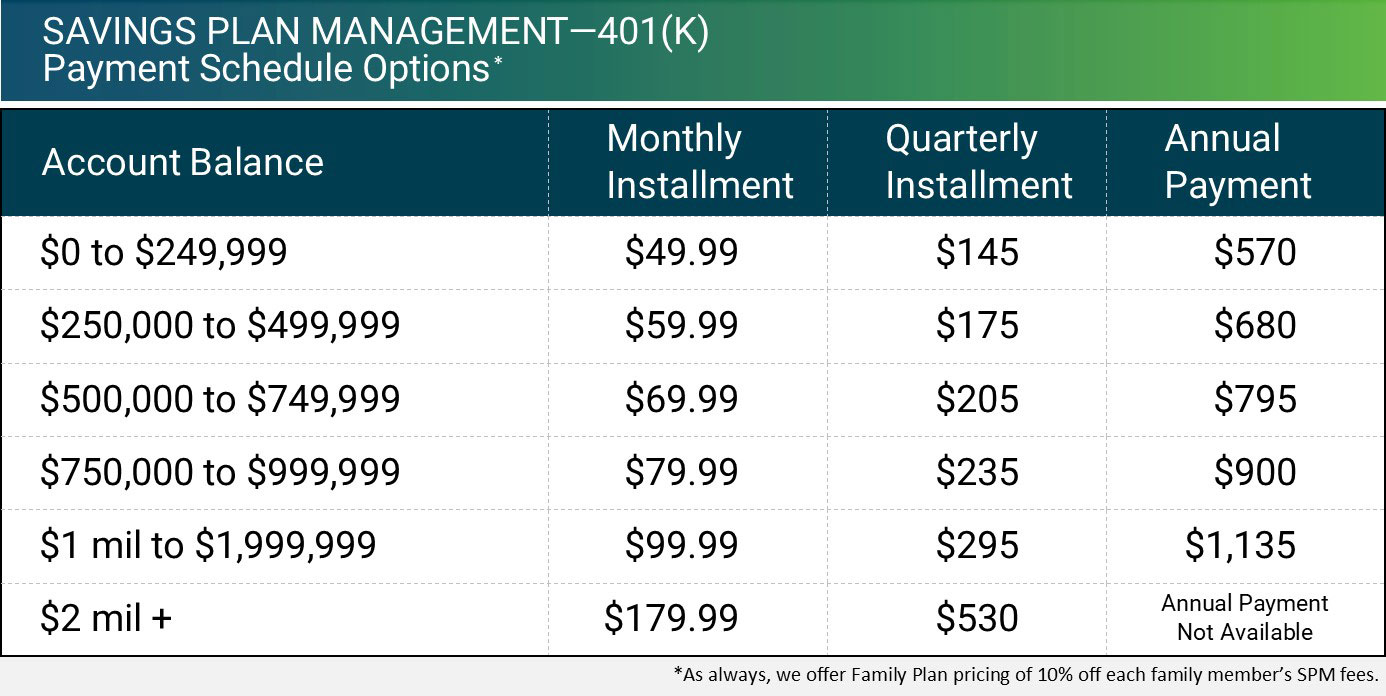

Management Services for as little as $49.99/mo. nationwide

Are you 5, 10, 20, or 30 years from retiring? It’s never too late. Or too early, to get started. We will customize a strategy for your unique needs and goals.

How it Works

Our services start with you completing a set of online Pre-Meeting Questions. Once we receive those, we’all reach out to schedule a complimentary introductory meeting. All our services begin with a complimentary consultation.

Here’s what you can expect:

- During the Introductory and Getting To Know You meetings your advisor learns about you, your financial needs, goals, and risk tolerance. Then, we’ll get to work helping to create a customized retirement strategy for you.

- Next, your 401(k) plan’s options will be analyzed, and a custom asset allocation strategy based on your risk profile will be constructed and put into action.

- You’ll get an action plan that tells you what contribution rates are needed to stay on track to your goals.

- We’ll monitor and rebalance as needed.

- You’ll gain unlimited access to your advisor by email or phone.

- In addition to free educational seminars and a subscription to your advisor’s weekly financial newsletter.

- For more info check out our Frequently Asked Questions or Contact Us.

For over 35 years Scarborough Capital Management had helped thousands of employees across the country understand and manage their retirement accounts.

We Make it Easy, We Do The Work For You

What Does It Cost?

Expanded Services – As Your Need Evolve So Do Our Services

Savings Plan Management Services – 401(k)

Wealth Management Services

Pension Buyout Analysis

Social Security Analysis

Flat fees ensure transparency, providing clarity on service costs without surprises. Learn more about our No Surprises fee policy.