If you’re a federal employee or in the military, you will likely have a Thrift Savings Plan. Fortunately for you, this is the most straightforward of all the retirement plans available to American workers.

However, it’s still not easy to manage your own account. There’s questions you will have to answer:

- How much money will I need at retirement and how much will this account generate for me then?

- How much should I contribute every month?

- How much risk should I be taking?

- Which investments should I buy?

- How do I know when to sell something?

- What might happen to my investments if the stock market drops (or interest rates rise)?

Unless you’re in the investment industry, that makes it really hard to feel confident you’re doing things right.

Choosing to work with a professional financial advisor can be a wise decision.

Personal financial advisors may provide the expertise, financial guidance, and personal relationships to help you become a wealth accumulator.

A Scarborough financial advisor can help you map out all of your financial goals and then help you work toward them one by one!

You should have the ability to hire a financial advisor of your choice! However, if the financial advisor of your choice doesn’t have a business relationship with your employer, they are at an advantage in providing investment management services for your employer-sponsored retirement account.

The qualified custodian of the account – generally a large investment or insurance company- will not give your financial advisor direct access to your account, as they may for other types of investment accounts. So Scarborough advisors overcame those hurdles with the Savings Plan Management service administered by Retirement Management Systems (RMS).

An Affordable Monthly Subscription

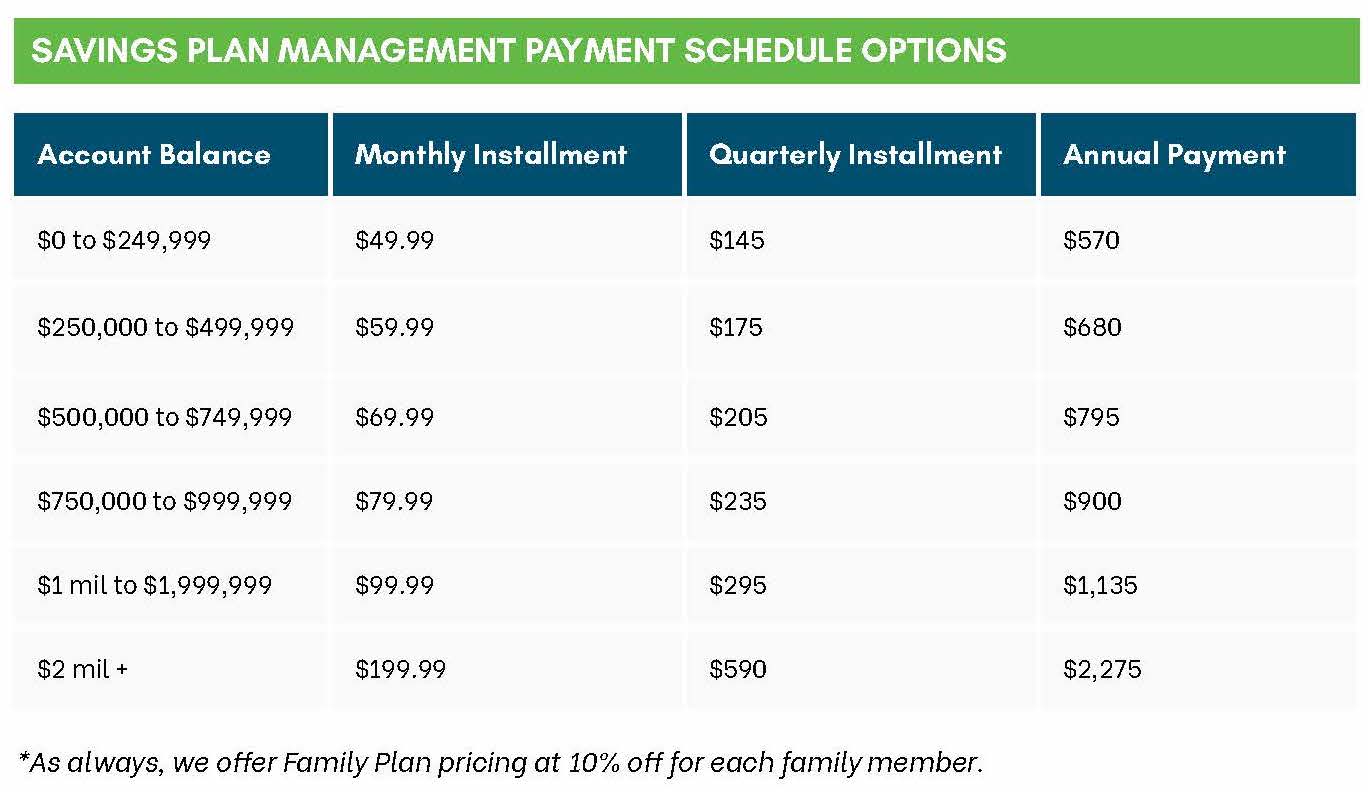

At Scarborough Capital Management, we’ve been helping people with their TSP accounts for over 30 years. Instead of some complicated arrangement, we keep it simple: we’ll manage your account for an afforable monthly subscription.

What Does It Cost?

How Does It Work?

At Scarborough, we’re big on transparency, too. So here’s what you can expect with our Savings Plan Management service for your TSP account:

- Scarborough advisors partner with Retirement Management Systems (RMS) to provide you Savings Plan Management services.

- Your Scarborough advisor will schedule an online or phone meeting with you first, so we can learn about your financial needs, goals and ability to tolerate risk. Then, he or she will work with you to create a customized retirement strategy just for you.

- You’ll get an action plan that tells you what contribution rates are needed to stay on track to your goals.

- RMS administers the service by analyzing your plan’s options and constructing a custom asset allocation strategy using the investment available within your plan. They will allocate according to your Scarborough advisor’s risk profile recommendations.

- Your advisor will help you monitor your progress along the way, and adjust your plan if your personal circumstances change.

- Your retirement account will be managed in accordance with the strategy agreed upon with your advisor. Your account will be periodically rebalanced to ensure that you aren’t taking too much, or too little risk.

- You’ll receive unlimited access to your advisor by email or phone.

- You’ll get access to free educational seminars and receive a free subscription to your advisor’s weekly financial newsletter.

There’s nothing magical about building wealth; but execution is the key. With our services, you’ll have an advisor who will keep you accountable to your own goals. That’s how you can build a better future.

With these flat fees, you’ll always know exactly how much the service costs. And you’ll never get a surprise bill from us. Learn more about our No Surprises fee policy.

Q. What’s the difference between this service and a Lifecycle fund?

Lifecycle funds are very popular in TSP accounts. In theory, the idea is a good one. Pool all the money of people who plan to retire around 2040, and invest it for them.

One problem, however….the lifecycle fund assumes everyone who retires in 2040 is the same. Same number of dependents, same responsibilities, same income. As we all know, most of us are very different. A two income family without kids is going to have a different risk profile than a single parent with two kids. So there’s an often overlooked risk to lifecycle funds since they are not personalized to you.

Our service, on the other hand, is completely personalized, so you don’t take more—or less—risk than you should be taking.

Also our service includes unlimited support with your own dedicated advisor. So you can ask questions about contributions, withdrawals, loans, or anything.

In fact, just having an advisor who knows your goals will help you stay accountable…to yourself! Lifecycle funds unfortunately offer none of these benefits.

Q. How can I follow what you are doing?

You need to know where your money is at all times, so you’ll continue to have full access to your CSRS or FERS login and see your holdings and balances.

Q. Am I stuck in a contract if I don’t like the service?

No, you can cancel this service at any time. We want satisfied clients and we think you’ll find the service so helpful and anxiety-relieving you’ll want to stick around!

Q. Do I need to move my account?

No, there’s no change required. As long as online access to your plan information is available we can help.