If you have a 403(b) plan at work, it can usually seem confusing. That’s no surprise…it probably is! While each plan is different, 403(b) plans are known for a few things:

- You may have a dizzying number of investment choices, far more than other types of retirement plans

- You’re likely to encounter more complicated investment options, like annuities and other insurance products

- Some of your investment choices such as annuities tend to carry much higher fees, which can handicap your ability to grow your money

All these factors make it hard to feel confident you’re doing the best thing for your future.

Choosing to work with a professional financial advisor can be a wise decision.

Personal financial advisors may provide the expertise, financial guidance, and personal relationships to help you become a wealth accumulator.

A Scarborough financial advisor can help you map out all of your financial goals and then help you work toward them one by one!

You should have the ability to hire a financial advisor of your choice! However, if the financial advisor of your choice doesn’t have a business relationship with your employer, they are at an advantage in providing investment management services for your employer-sponsored retirement account.

The qualified custodian of the account – generally a large investment or insurance company- will not give your financial advisor direct access to your account, as they may for other types of investment accounts. So Scarborough advisors overcame those hurdles with the Savings Plan Management service administered by Retirement Management Systems (RMS).

An Affordable Monthly Subscription

At Scarborough Capital Management, we’ve been helping people with their 403(b) accounts for over 30 years. To keep it simple, we offer the service for a monthly subscription fee.

How Does It Work?

We believe simple and transparent is best for us…and best for you. So here’s what you can expect with our Savings Plan Management service for your 403(b) account:

- Scarborough works hand in hand with Retirement Management Systems (RMS) to provide you Savings Plan Management services.

- After you sign up, you’ll receive a link to upload some information and link your accounts. The entire process uses advanced security and encryption to keep your information safe.

- You’ll then be prompted to schedule a virtual meeting with your Scarborough advisor. During that meeting, we’ll learn about your financial needs, goals and ability to tolerate risk.

- Then, your advisor will create a customized retirement strategy, just for you, and review it with you.

- You’ll get an action plan that tells you when to adjust your contribution rates to keep on track to your goals.

- RMS administers the service by analyzing your plan’s options and constructing a custom asset allocation strategy using the investments available within your plan. They will allocate according to your Scarborough advisor’s risk profile recommendations.

- Your advisor will help you monitor your progress along the way, and adjust your plan if your personal circumstances change.

- Your retirement account will be monitored and managed in accordance with the strategy agreed upon with your advisor. Your account will be periodically rebalanced to ensure that you aren’t taking too much, or too little risk.

- You’ll have unlimited access to your advisor by email or phone.

- You’ll get access to free educational seminars and receive a free subscription to your advisor’s weekly financial newsletter.

With these services, you’ll always have your advisor at your side to keep you accountable to your own goals. That can help you create a more confident future.

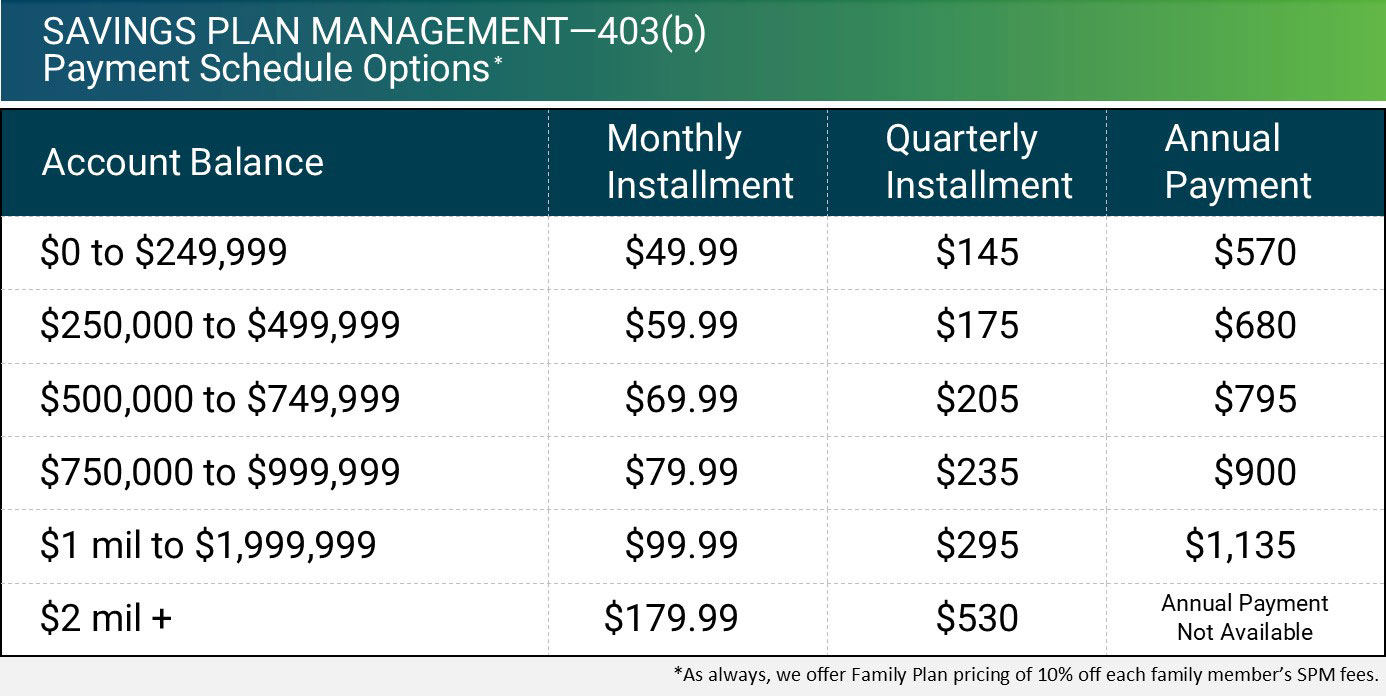

What Does It Cost?

All of our services are flat fees, with no hourly charges. That way you’ll always know exactly how much the service costs in advance. Learn more about our No Surprises fee policy.

Q. What’s the difference between this service and a target date fund?

Target date funds are extremely popular and can be found in many retirement plans. In theory, the idea is good. Combine all the money of people who plan to retire in 2040, and invest it for them.

One big problem exists, however….the target date fund assumes everyone who retires in 2040 is “average”. Average income, average number of dependents, average assets and debt. As we all know, in reality, most of us are very different. A two income family without kids is going to have a dramatically different risk profile than a single parent with two kids. So there’s an often overlooked risk to target date funds since they are not personalized to you….at all.

Our service, on the other hand, is completely personalized, so you don’t take more—or less—risk than you should be taking.

Also our service includes unlimited support with your own dedicated advisor. So you can ask questions about contributions, withdrawals, loans, or anything.

In fact, just having an advisor who knows your goals will help you stay accountable…to yourself! Target date funds unfortunately offer none of these benefits.

Q. How can I follow what you are doing?

You need to know where your money is at all times, so you’ll continue to have full access to your workplace login and see your holdings and balances.

Q. Am I stuck in a contract if I don’t like the service?

No, you can cancel this service at any time. We want satisfied clients and we think you’ll find the service so helpful and anxiety-relieving you’ll want to stick around!

Q. Do I need to move my account?

No. There’s no change required. As long as online access to your plan information is available we can help.