Ready to get on the road to financial freedom?

Financial security doesn’t just happen. But the good news is…it is within reach. It just involves creating a plan, then consistently sticking to it.

When you’re ready to get serious about your future, our team of CERTIFIED FINANCIAL PLANNER™ and CHARTERED RETIREMENT PLANNING COUNSELOR™ professionals are ready to help. Financial planning is the place to start. There’s nothing we love more than helping you map out all of your financial goals….then helping you work toward them one by one!

How Does It Work?

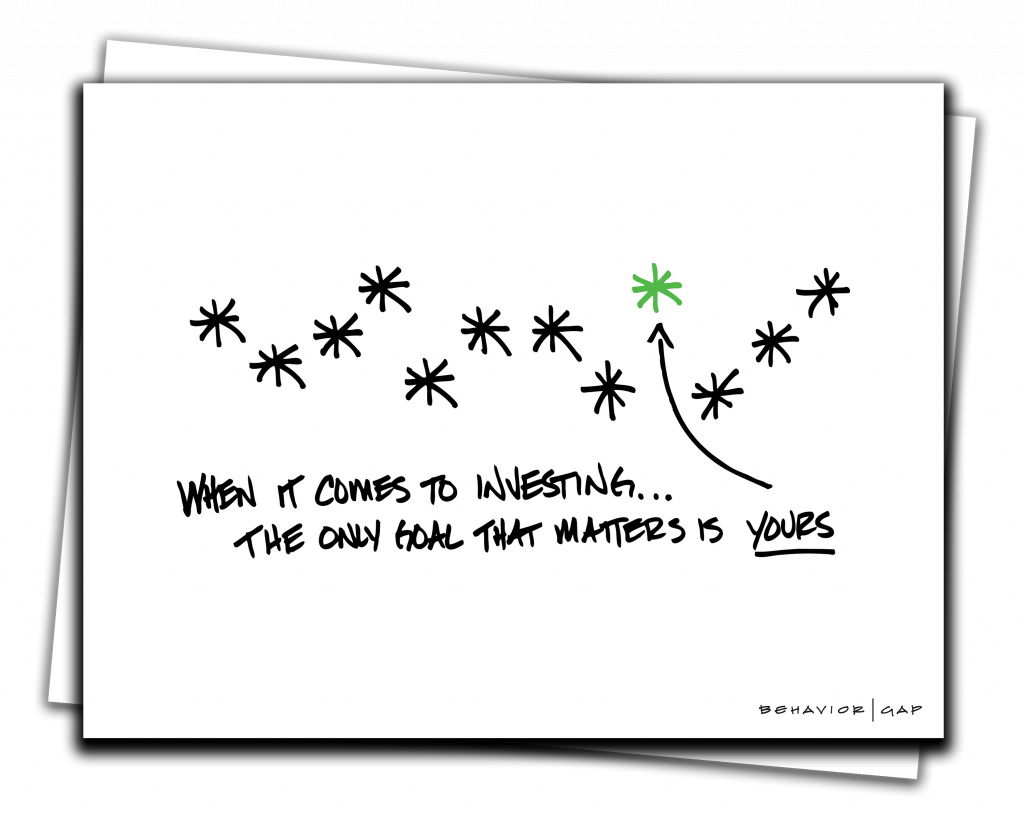

Financial planning means different things to different people. But here at Scarborough Capital Management, we make sure it’s one thing: personal.

That’s because a plan with just numbers is not likely to do much more than sit on your shelf. On the other hand, real financial planning can be extremely motivating. That’s because it’s less about numbers and more about you:

- What do you want your future to look like?

- Where are you starting from?

- What are your responsibilities?

- How comfortable are you with taking risk and accepting ups and downs in your nest egg?

Once we learn all of this about you, we build a customized strategy that’s just for you.

The type of plan you need may vary depending upon your age and stage of life.

Financial Needs Analysis

55 years or younger?

This personalized, goal-based analysis will help you make sense of your current financial picture as well as the road ahead.

This process will address questions such as:

- When can I afford to retire?

- How much money will I have at retirement given my current savings rate?

- How should I invest my retirement assets to help achieve my goals?

- What’s the best way for me to fund college costs, long-term care insurance, or other large expenses?

Comprehensive Financial Plan

Nearing Retirement? This more comprehensive plan builds upon your Financial Needs Analysis. In it, we take a cash-flow based approach to addressing these types of questions:

- How long will my money last during retirement?

- When should I take Social Security?

- What’s the best way to plan ahead for healthcare expenses?

- How do I help ensure that my loved ones are protected?

- What’s the best tax strategy for my situation?

And much, much more. You’ll end up with a plan that maps out the road ahead. Additionally, it will provide an action plan, so you always know your next steps.

What to Expect

Financial planning can seem intimidating, but it’s not. It can be stress relieving and enlightening! Our CERTIFIED FINANCIAL PLANNER™ and CHARTERED RETIREMENT PLANNING COUNSELOR™ professionals love helping people like you plan for your future, and deal with the obstacles that life throws at all of us at one time or another.

At the end of the process, we hope you’ll find many of your “what ifs” have been replaced with a straightforward action plan, that’s easy to implement.

Your financial advisor will be available after the process for any of your questions and follow up concerns.

Certified Financial Planner Board of Standards Inc. (CFP) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and CFP (with plaque design) in the United States., which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.